L

ast month, Republican lawmakers axed a proposed tax hike by Gov. John Kasich that would have raised Ohio’s near non-existent severance tax on oil and gas drilling.

Currently less than 1 percent, Kasich’s proposed increase — to 6.5 percent on natural gas and oil and to 4.5 percent on natural gas liquids — was his third attempt at increasing the tax on non-renewable energy sources in what has been a three-year battle against Republican lawmakers.

Statehouse Republicans and the oil and gas industry have fought against the tax, claiming the increase could lead to job cuts and stifle industry growth. During a June 16 press conference, Ohio Senate President Keith Faber (R-Celina) and House Leader Cliff Rosenberger (R-Clarksville) announced the cutting of Kasich’s proposed fracking tax increase from the two-year state budget, which Kasich signed into law June 30.

Faber and Rosenberger are instead creating a task force that will consist of six lawmakers — two Republicans and one Democrat from each chamber — along with Kasich’s budget director, Timothy Keen, to discuss their differences and produce a report with recommendations by Oct. 1.

“The thing we are committed to continue today is open and frank dialogue on where we could find common ground to move forward for the industry and for the tax policy of the state,” Rosenberger said.

The task force’s recommendations will not ensure the tax is passed, and they won’t include a deadline. Faber defended the decision during the press conference, saying the move is not a GOP stalling technique, but rather a chance to work out a compromise between the two sides.

“Make no mistake: There’s going to be a solution to this problem,” Faber said. “And lest one side thinks they can drag it out or extend the ball, that’s not an option, because there will be a solution next time.”

Environmental advocates and other progressive groups have criticized the elimination of the tax hike. Ohio’s oil and gas production has doubled in a year’s time and continues to grow in a state with one of the lowest taxes in the country for drilling.

“We need the money that a frack tax would bring in, because fracking is costly to communities,” says Wendy Patton of liberal-leaning think tank Policy Matters Ohio. “Roads need widening and strengthening to carry tankers of brine used in drilling. Rent rises as work crews move in and affordable housing becomes scarce.”

Policy Matters Ohio and other groups that support the tax point to data showing that oil and natural gas production in Ohio is rapidly increasing. According to the Ohio Department of Natural Resources, Ohio produced 2 million barrels of oil and 67 billion cubic feet of natural gas in the first quarter of 2014. In the same period this year, the state has produced 4.4 million barrels of oil and 183 billion cubic feet of natural gas, more than twice as much in each case.

Ohio currently charges just 20 cents per barrel of oil and 3 cents per 1,000 square feet of natural gas, a rate Kasich described to the Columbus Dispatch as a “total and complete rip-off to the people of this state.”

The governor’s latest proposal was higher than previous suggestions, but modest compared to other parts of the country. North Dakota, which changes its tax based on the current market price, currently charges 5 percent on oil and 98 cents per 1,000 cubic feet of gas. Neighboring West Virginia charges 5 percent on gas and oil.

Kasich’s proposed 2.5 percent tax increase last year, which died in the Senate, would have sent 20 percent to counties with wells and the rest to support income tax cuts. The prioritization of funding tax cuts rather than reinvestment in the communities where fracking is happening has drawn criticism as well.

Melanie Houston, director of water policy and environmental health at Ohio Environmental Council, said that although OEC would like to see a severance tax higher than Kasich’s proposal, it is more concerned that the tax revenue would go back into the local communities affected by fracking and into the Ohio Department of Natural Resources’ Oil and Gas Division to oversee and regulate the operation.

“This is not going to put (the oil and gas companies) out of business or cause them to leave the region,” Houston says. “The resource is here, and they’ve already begun tapping it, and they’re going to continue doing that. So I think we should look at a number that is respectable for our state and allows us to tap into the resource that’s being severed from the ground.”

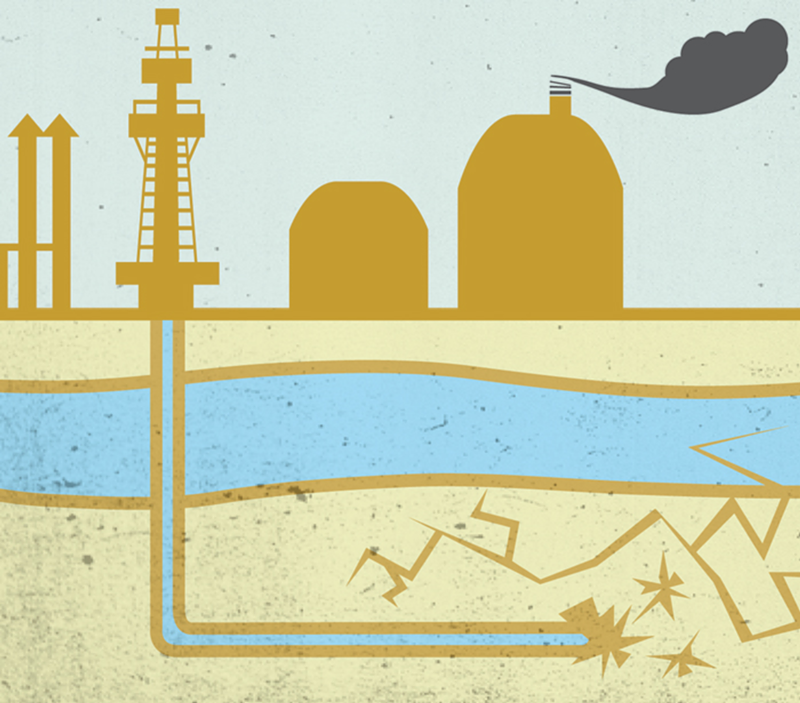

Ohio began fracking in 2011. The wells are mainly in the Appalachian counties in the eastern part of the state in rural areas. Many communities have experienced significant disruptions from the installation and use of fracking wells.

The process has been controversial because of high amounts of water and undisclosed chemicals used to drill and extract trapped gas from shale rock. In January, a study published in The Bulletin of the Seismological Society of America concluded that fracking caused earthquakes in northeastern Ohio. State and federal experts have made the same connection in other states.

Because fracking is a relatively new process, the long-term health effects of living near a site are still unknown. A recent University of Pittsburg study found that Pennsylvanian women who lived near fracking sites were 34 percent more likely to have babies with lower birth weights.

Some environmental groups want to see the state step back and introduce oversight and evaluation into the fracking process.

“Our taxes aren’t as high as other states. I understand that,” says Alison Auciello of Food and Water Watch, a consumer protection organization. “But we’ve been rushing into fracking in the first place. We skipped evaluating what we should be doing about lots of other things and skipped right ahead to how much money we can make on this. Taxing fracking isn’t going to make it safe.”

The American Petroleum Institute aired a radio ad throughout Ohio in May, which claimed raising taxes on oil and gas could affect the middle class through potential job cuts and an increase in the cost of utilities. Both the American Petroleum Institute and the Ohio Gas Association released statements in support of the task force and thanked legislators for working with them.

The tax is out of Kasich’s hands for now, and it is up to the task force to recommend what proposal will go forth to the budget. GOP leaders haven’t outright said they would support an increase.

Gov. Kasich’s office didn’t respond to a request for comment for this story.

“I hope they’ll come up with something that’s good,” Kasich said during a speech in Lansing, Mich., last month. “If they come up with something that’s puny, it won’t be acceptable.”

The committee might have a tighter deadline than anticipated. The Columbus Dispatch reported last week that the task force technically has just 24 hours to meet and produce its report. According to the budget Kasich signed June 30, the task force doesn’t exist until Sept. 30 — just a day before Faber and Rosenberger’s deadline. ©