The New York Times reported on Sunday that President Donald Trump paid a mere $750 in federal income taxes in 2016 and 2017. The revelations are a reminder of how the nation's tax system benefits the wealthy at the expense of middle-class and lower-income households.

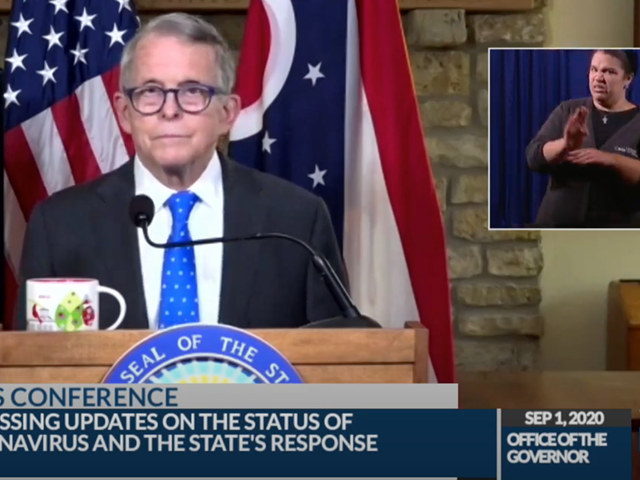

University of Kentucky Law Professor Jennifer Bird-Pollan said most Americans earn salary income from an employer, and these dollars are taxed at higher rates than income earned by investments or through business partnerships. But, she added, the $750 figure reportedly paid by the president still doesn't quite make sense.

"Now, what's extra strange is this $750 number. The fact that it's this nice, round number, and the fact that it's the same number for two years in a row, I think has a lot of people hypothesizing that this is just a number they made up, so that when asked if he paid any income taxes he'd be able to say yes," Bird-Pollen said.

The president has denounced the reporting on his finances and accused the investigation of being fake news. One study by the Economic Policy Institute found the federal tax system led to a more than 30% increase in U.S. income inequality between 1979 and 2007.

Bird-Pollan pointed out the tax code also allows for a slew of deductions and other loopholes that reduces the amount of income corporations are required to pay taxes on. As a result, some of the nation's largest corporations such as Amazon and Netflix paid zero income taxes in recent years, despite earning hundreds of millions of dollars in profits.

She added the significant changes made to the U.S. tax code in 2017 expanded such perks for corporate America.

"Most of the benefit from the 2017 tax law went to corporations in particular, who saw a pretty dramatic cut in their statutory tax rate, it went from 35% to 21%," she said. "They were able to take additional amounts of deductions; in particular, depreciation and expensing deductions, in a way that they weren't before that tax law."

Bird-Pollan said the tax system will contribute to worsening inequality driven by the coronavirus pandemic.

"People aren't going to get their tax refunds until next year. If you can't make your rent payments right now, waiting until March or April to get a tax refund is not going to help you," she said.

She said to help people get back on their feet, tax deductions don't help as much as direct payments such as the $1,200 stimulus check Americans received earlier this year, or student loan forgiveness, which Bird-Pollan said are more effective measures during times of crisis.