Hey all. Let’s talk about news for a minute.

Now that Union Terminal looks to be on its way to renovation and Music Hall has received significant contributions toward the cost of its own fix-up, some preservationists have focused again on Memorial Hall. The building, which sits next to Music Hall on the west side of Washington Park, was designed by renowned architect Samuel Hannaford and built in 1908. Its needs are not quite as large as its gargantuan neighbor: The total cost for renovations is expected to be about $8 million, mere chump change compared to the $120 million Music Hall renovations could run. Development group 3CDC is one of the main drivers of fundraising efforts. It asked Hamilton County Commissioners yesterday for a $1.5 million contribution from the county. Though commissioners wouldn’t commit to anything just yet, Commissioner Greg Hartmann has said some contribution is likely since the building is owned by the county.

• So I’m not a beer fan overall, but I love a good porter on a cold winter day. You know what else I love on a cold winter day (like today, for example)? Cincinnati chili. Having established those facts, let’s just say I’m intrigued by a new beer debuting soon. Blank Slate Brewing Co. has created the Cincy 3-way Porter, which has subtle notes of the spices that make Cincinnati chili famous (or infamous depending on your palate). Again: I like Cincy chili. I like a good porter. But can this possibly be good? Of course I’m going to try it and find out. One note to consider: According to this story in the Business Courier, the malt used to brew the beer is smoked with the distinctive spices — they don’t go in the beer itself. That hopefully means it doesn’t taste like sipping on a serving of Cincy’s favorite meat sauce that just happens to be 7 percent alcohol by volume. Though, hey, I might be open to that, too.

• Is there a way the $2.8 billion Brent Spence Bridge project might be funded without tolls? Don’t hold your breath just yet, but anti-toll groups hope so. Anti-toll group Northern Kentucky United is touting a plan proposed by Sens. Rand Paul and Barbara Boxer that would raise money for the federal Highway Trust Fund by giving U.S. corporations tax breaks to bring more of their estimated $2 trillion in foreign profits back to the U.S. If some of that money flows back here, prodded by a tax break, it could be taxed and the receipts used on infrastructure projects like the Brent Spence Bridge. At least, that’s what Northern Kentucky United hopes. The proposal is very similar to one that President Barack Obama has tucked into his budget, which he released yesterday. The anti-toll group says that’s a sign that things could be happening on the federal level and that a plan to use tolls to pay for the bridge’s replacement is premature.

“There are details yet to be worked out, but the similarities between what the president has suggested and the bipartisan proposal out of the Senate gives us good reason to be optimistic,” said Marisa McNee of Northern Kentucky United in a statement on the legislation. “There is simply no reason to continue a rush to toll the Brent Spence Bridge when the White House and Congress appear to be moving towards an agreement on the Highway Trust Fund,” McNee concluded.

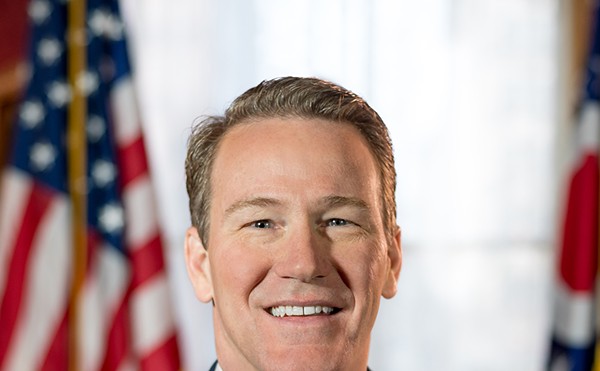

Govs. John Kasich of Ohio and Steve Beshear of Kentucky presented their plan last week for the bridge, which includes tolls as part of the funding equation. Kasich has cited the increasing costs for the project while it’s delayed — $7 million a month, by some estimates — as a reason officials should move quickly. He claims there’s little chance the federal government will be forthcoming with funds for the project. Currently, the Highway Trust Fund faces insolvency this summer if Congress doesn’t approve new sources of income for infrastructure.

• The Hamilton County Sheriff's Office and Cincinnati’s Police Department don’t reflect the area’s demographic makeup, according to data released by both departments and reported by the Cincinnati Enquirer. Hamilton County’s department is 86 percent white and 12 percent black, though the county itself is 62 percent white and 26 percent black. A similar disparity exists in Cincinnati, which is 48 percent white and 45 percent black. Yet its police force is 67 percent white and 30 percent black. Both gaps match up with many other police forces around the country. A study by USA Today found that 80 departments out of 282 in cities with more than 100,000 people had greater than a 10 percentage-point gap between the proportion of black officers and black residents.

• Yesterday was a day for budgets. In addition to the release of President Obama’s budget proposal (more on that in a minute), Gov. John Kasich also released his financial proposals for Ohio’s next two years. Kasich looks to cut income taxes while raising sales taxes, among other moves, which could place more burden on the state’s low-income workers. Kasich has also suggested an increased tax exemption for some of those workers, but that exemption is small and may only account for two or three bucks more in a worker’s paycheck.

On the income tax side, Kasich seeks to cut the state’s rate by 23 percent over the next two years and end the state’s income tax for 900,000 business owners grossing less than $2 million a year. To pay for that, the state’s base sales tax rate will go up to 6.25 percent plus county and local sales taxes. In Hamilton County, the sales tax rate will go up to 7.5 percent. This continues a trend toward relying more on sales tax to fill the state's coffers, something progressive groups say has made the state's tax system more and more regressive over the last few years.

All told, the state will take in $500 million less over the next two years, a nice hefty tax cut Kasich can point to in order to rally the Republican base should he decide to run for president in 2016. You can read more about the finer points of Kasich’s budget in our story here.

• Finally, here’s a breakdown of President Obama’s wide-ranging, $4 trillion budget proposal. Obama looks to raise taxes on corporations and wealthy citizens and give middle class families tax breaks. He calls that plan “middle class economics,” though staunch conservative (and fellow Miami alum) House Ways and Means Committee Chairman Paul Ryan has his own name for it: “envy economics.” Those two monikers may foreshadow another long, arduous budget process between Obama and a mostly Republican Congress.

Other points of Obama’s budget: He has proposed the aforementioned plan for paying for infrastructure, a pay raise for federal workers and military personnel and a number of other proposals you can peruse in the story above. Also worth checking out: this breakdown of the budget by federal departments. Let’s play a little game of “one of these things is not like the other.” That’s right: Discretionary spending at the Department of Defense is a mind-blowing $585 billion. That’s more than every other department combined. Obama’s budget increases the DOD’s budget by 4 percent. That’s $23 billion — enough to increase the Department of Housing and Urban Development’s budget by almost 50 percent. Just leaving that right there for you to chew on.