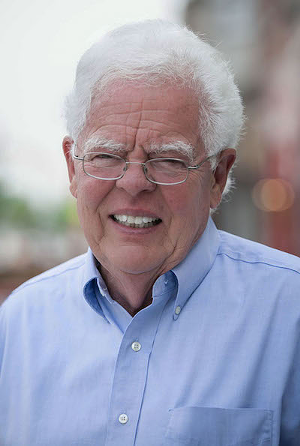

A proposed ordinance released by Cincinnati City Council member David Mann yesterday would levy a 7 percent excise tax on short-term rentals such as those listed on sites like Airbnb and would require those rentals to be registered and certified compliant with city safety regulations.

Under the potential new law, the tax receipts collected by sites like Airbnb would go to the city's recently-created affordable housing trust fund.

Mann's new ordinance:

- Requires every host to register to operate each of his or her units listed on a short term rental platform

- Requires every host to display a registration number in the corresponding online short-term rental listing

- Requires hosts in buildings with four or more units to obtain a certification from an architect or engineer that the short term rental unit is in compliance with the codes that apply to the dwelling unit and the building

- Levies a 7 percent excise tax on all short-term rentals and earmarks the revenue for the Affordable Housing Trust Fund (proposed by the Short Term Rental host advocates)

- Recognizes that the short-term rental industry is distinct from the hotel industry and accordingly does not apply to hotels otherwise regulated by the municipal code

- Regulates the number of units per building that are permitted to be operated as short-term rentals:

- For buildings containing four or fewer dwelling units, there is no limit on the number of short-term rentals that may be operated in the building

- For buildings containing five or more dwelling units, four short-term rentals plus one additional short-term rental for every four dwelling units in excess of four dwelling units is permitted.

The proposal represents a change from past versions of the ordinance Mann put forward last year, which sought to cap the number of whole-building rentals an owner could operate in the city. The new proposal doesn't distinguish between owner-occupied rentals and whole-building rentals and doesn't require code compliance certification for operators running less than three units.

"My office has met extensively with an intensely interested group of Airbnb hosts, and we have heard from many neighborhood representatives and affordable housing advocates who are anxious to preserve the fabric of their neighborhoods and fund the newly established Affordable Housing Trust Fund," Mann said in a press release. "We heard concerns from my colleagues on City Council who do not want to over-regulate this new industry in our City, and we have settled on regulations that are narrowly focused on what matters most: safety."

Airbnb, and other sites like it, allow property owners to rent rooms or whole buildings for short-term stays, similar to a hotel — except currently, owners don't pay a lodgings tax the way hotels do. Airbnb and similar companies don't own any real estate but simply broker the transaction between the owner and guest via an app or website in exchange for a small fee.

Cincinnati has about 880 active Airbnb rentals, according to AIRDNA, an independent site that tracks the rentals in many cities. That's up from about 830 last November and 640 the site showed this time last year. About 70 percent of those are rentals encompassing an entire house, condo or apartment — up from 60 percent this time last year. The city has seen a 41 percent annual growth rate in those rentals in recent years.

That can sometimes incentivize property owners, or investors who buy up rental properties, to convert traditional houses or apartment buildings into full-time Airbnb sites, which critics say can, in turn, displace residents and eat into a city's housing stock. Cities like Seattle, San Francisco, Philadelphia and New York have passed or attempted to pass restrictions on short-term rentals so they don't exacerbate housing shortages there.

It isn't clear exactly what impact short-term rentals have had on the city's affordable housing inventory, and some short-term rental owners and supporters say the rentals bring benefits, not downsides. But Cincinnati's low-cost housing stock is in short supply — something tax revenue could help with. Cincinnati currently needs about 30,000 more units of housing that is affordable to its lowest-income residents, according to estimates from the Ohio Housing Finance Agency.

Average rent in Cincinnati is roughly $900 a month, meaning landlords only need to rent out their properties on Airbnb at the city’s average rate of $109 a day for roughly 10 days to make the same return. Some community members and nonprofit leaders such as Over the Rhine Community Housing Director Mary Burke Rivers, Greater Cincinnati Homeless Coalition Director Josh Spring and Over-the-Rhine resident Margy Waller sent a letter to Cincinnati City Council last August asking elected officials to enact restrictions on the practice of renting buildings on Airbnb.

"We have seen neighbors evicted from 'naturally occurring affordable housing' (rental homes that are affordable without public subsidy) in rapidly changing neighborhoods, housing that has been replaced with non-owner-occupied full-time Airbnb rentals," the letter reads. "We have seen newly-renovated housing marketed and sold to investors as non-owner-occupied full-time Airbnb rentals — and kept off the market to renters. We have seen developers attempt to turn entire buildings into illegal Airbnb hotels in Over-the-Rhine."

The group goes on to say that such activity leads to the loss of full-time neighborhood residents who are invested in the communities they live in.

But some Airbnb operators take issue with the group's assessment, saying that their units don't harm the neighborhood but instead bring it economic benefit. Some proponents of the short-term rental sites point to data showing guests tend to stay in neighborhoods longer and spend more at local businesses than hotel guests. They also point out that some buildings currently hosting Airbnb guests would otherwise be vacant, and that the temporary income property owners get from Airbnb could make rehab jobs viable when they otherwise wouldn't be.

Cincinnati City Council's Budget and Finance Committee could consider Mann's ordinance at its April 1 meeting.