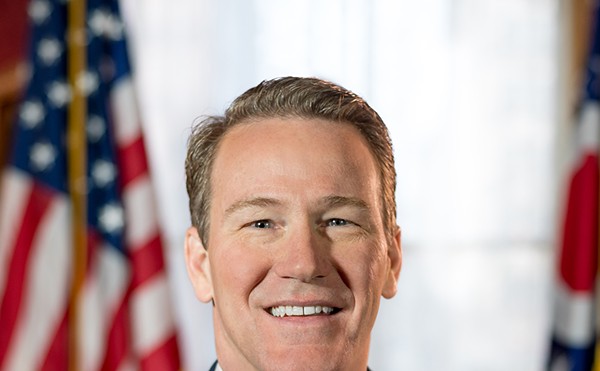

Gearing up for a campaign season of playing David to the GOP's well-funded Goliath, Democrats have loaded their slingshots with allegations that Ohio Treasurer Joseph Deter is operating a pay-to-play system and using the Hamilton County Republican Party (HCRP) to launder the proceeds.

Fueling these allegations are contributions made by investment brokers whose firms enjoyed profitable business relationships with the treasurer's office.

Between 1999 and 2001, SG Cowen Corp. and Lehman Brothers Inc., firms for whom Cleveland broker Frank Gruttadauria worked, traded $5.9 billion worth of securities for the state. Gruttadauria, who currently sits in Trumbull County jail on charges of defrauding $277 million from his clients, contributed $50,000 to the HCRP's operating fund shortly before turning himself over to the FBI in February. He also served on a committee that raised an additional $38,000 for Deters.

And last month The Columbus Dispatch reported that five Columbus-based investment brokers, whose firms collectively traded more than $6 billion for the state treasury and garnered an additional $1.16 million in investment advisory fees for work related to the treasury's STAR Ohio fund, contributed $100,000 to the HCRP local candidate fund and $25,000 to the HCRP state candidate fund.

These contributions didn't flow into the county party coffers unsolicited. Shortly after becoming chairman of the HCRP, a position he held from December 1999 to March 2001, Deters hired Eric Sagun to raise funds for both the county party and for his own campaign. As part of this fund-raising effort, Sagun targeted those individuals who had business relationships with the treasurer's office.

But, according to Deters campaign spokesperson Linda Peterson, no connection exists between political contributions and doing business with the treasurer's office.

"There are people who do business with the state and the treasurer's office who give no money," Peterson said. "There are some who give, but there's no correlation between the money they give and the work they do for the state."

Others aren't convinced. At a March 14 news conference, Sen. Leigh Herrington, D-Ravenna, said that there appeared to be a "quid pro quo between Gruttadauria and Joseph Deters." Other prominent Ohio Democrats, including state party chairman David Leland, gubernatorial candidate Tim Hagan and Mary Boyle, Deters' opponent for the state treasurer's office, have leveled similar accusations at Deters.

But, unless the brokers were told that campaign contributions would enhance their chances of doing business with the treasurer's office, such solicitation is legal under Ohio law.

The state's campaign finance law prevents individuals who perform work under an unbid contract with the state from contributing more than $1,000 to the campaign of the public official who wields the ultimate authority over that contract.

As an investment advisor for the STAR Ohio fund, Dennis Yacobozzi of United American Capital works under such an unbid contract. His $25,000 contribution, however, didn't go to Deters' campaign but to the HCRP's local fund, which is earmarked for financing candidates for offices within Hamilton County.

Brokers who perform securities trades for the treasurer's office don't generally work under contract and can legally contribute directly to the campaign of the individual from whom they receive business. But Democrats have publicly argued that Deters might have circumvented Ohio's campaign finance laws by directing contributors to designate the money for certain accounts that aren't affected by these laws.

Annual contributions to a candidate are limited to $2,500 per year, and contributions to state political parties are capped at $15,000. Donations to political action committees are limited to $5,000, as are those to the state candidate fund of county political parties.

Not limited, however, are contributions to the local candidate funds of county political parties. Also not covered by statutory limits are contributions to political party operating funds, which must be used only to fund expenses such as party employee salaries, utility bills and maintenance costs. When contributing to these funds, Gruttadauria and the others weren't constrained by statutory limits.

Spokesperson Peterson contends, however, that these contributions didn't benefit Deters.

"The money that he (Gruttadauria) donated went to the operating fund and that doesn't go to candidates," Peterson said.

This is where the money laundering charges enter. Democrats have alleged that Deters used the HCRP's unconstrained operating account and local candidate fund to garner much larger contributions than could have been possible with direct candidate contributions. According to Democrats, the HCRP might then have funded Deters' campaign from its state candidate fund, the only fund from which it could legally contribute to his campaign.

At Deters' request, the HCRP funneled $303,621.83 into his campaign from March 2001 to January 2002, including a $100,000 contribution on Jan. 29, 2002. Gov. Bob Taft's re-election campaign received only $12,020 from the HCRP during the same period, while Secretary of State Kenneth Blackwell, also running for re-election, received just $94,500. Like Deters, both Taft and Blackwell began their political careers in Hamilton County and retain close ties to the area.

Democrats allege that this money laundering scenario also explains why investment brokers based in Columbus and Cleveland donated money to the Hamilton County GOP, already one of the richest county parties in the state.

But barring the revelation of any evidence that such a conspiracy took place, it appears that Deters has remained within the constraints of the law. Leland and Boyle have expressed concern that the Republican domination of state government will prevent the discovery of such evidence, if it exists.

As evidence of this lack of objectivity, both point to the composition of the Ohio Ethics Commission, which agreed earlier this month to review the potential for conflicts of interest when officeholders both award business and raise campaign funds.

The commission is typically comprised of three Democrats and three Republicans, but Gov. Taft has yet to fill one Democratic seat, giving Republicans the majority. Since 1991, the three Republican commissioners have collectively contributed $70,129 of reportable contributions to Republican candidates and GOP party funds.

The publicity surrounding Deters' fundraising tactics has focused attention on the gaping loopholes in Ohio's campaign finance laws that allow a conflict of interest to exist — people doing business with the state are able to donate unlimited sums of money to a county political party, which could then fund the re-election campaign of the person who awards that business.

The logical step to reducing the possibility for such conflicts of interest in the future is to establish reasonable limits on the contributions that political parties, political action committees and other such entities can accept from an individual into any and all accounts and funds. This would effectively limit the financial impact of any single donor and significantly reduce the profitability of laundering contributions through any one county political party. Laundering of significant amounts of money would require the cooperation of numerous county parties.

No such legislation is in the works. For now, we have nothing but our politicians' promises that no connection exists between political contributions and doing very profitable business with the state.