On its face, the concept seems simple and uncontroversial: Use increased money property owners pay in taxes as their property values rise to improve the areas around those properties.

But in reality, so-called Tax Increment Financing districts (TIFs) are more complicated — and contentious.

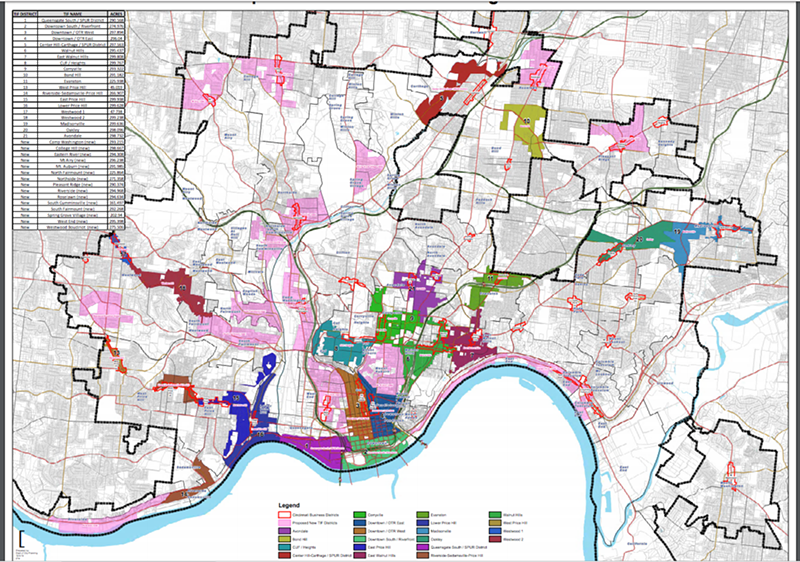

Next month, Cincinnati City Council is set to consider the addition of 15 new TIF districts, adding to the 20 that already exist. All of those were created prior to 2005, when the city ceased creating new districts due to questions around whether changes in state law prohibited making more.

But in a memo last month, Cincinnati City Manager Patrick Duhaney said that some neighborhoods have been asking about creating new districts, including one for housing funding in the West End. After doing some research, city administration says it believes it is legally possible to create more TIF districts in the city.

"After crafting a boundary for each district based on the main commercial corridor of the eligible areas within the neighborhood of up to 300 acres, the Administration has commenced a public engagement process that included notifying each property owner within the proposed TIF District as well as the community council and community development corporations active within the neighborhood," Duhaney wrote in the memo. "The early results of this engagement process indicate widespread support and excitement for the new resources that TIF Districts could bring to neighborhoods."

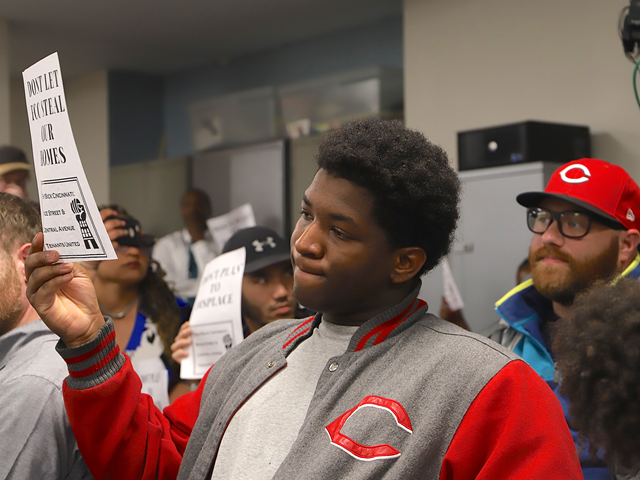

Not everyone is happy about the idea, though.

Among those raising alarms, perhaps not surprisingly, are members of the Cincinnati School Board. Board President Carolyn Jones called the potential new districts "a slap in the face" during the board's regular meeting Nov. 18.

CPS receives a large part of its funding from property taxes. Some of its advocates maintain that TIFs divert money away from the district at a time when enrollment is booming and funding from other sources is limited.

"The city's latest announcement -- of its intention to create 15 additional 300-acre TIF districts -- was the most offensive to the Board of Education," Jones told city council today, noting that the districts covered the maximum possible area, were for the maximum allowed value and extend for 30 years. "It is particularly disingenuous for the city to boast of its community engagement about these TIF proposals when no one from the city ever communicated with CPS regarding this proposal. The city's eleventh-hour effort to encircle the city in TIF districts is shameful and disrespectful to the Board of Education."

Other education advocates also blasted the TIF proposals in council.

"I don't think what you're doing is responsible," Cincinnati Federation of Teachers President Julie Sellers said, calling for an analysis of how the new districts would impact school funding.

The school board has been in a fairly intense battle with the city over the latter's tax abatement policies — a separate set of policies the city undertakes that allows those developing or renovating commercial or residential property to forego taxes on some or all of the improvements they make to their properties over the course of up to a decade. The city, which entered into an agreement in 1999 with the district allowing it to offer more generous abatements, says they are needed to incentivize development and that they actually gained the district revenue by tipping the scales of a state funding formula.

The district, however, strongly disagrees and says the city's generous abatements have cost it millions in funding.

Currently, the district receives 25 percent of taxes the city abates from developers for commercial real estate developments and 27 percent from developers for revenue diverted to TIF districts.

The agreement between the district and the city expires Dec. 31.

You can find more in-depth coverage of the tax abatement debate here and here.

Now, it looks as though the district, education advocates and city will battle it out over TIFs as well.

Existing TIF districts in Cincinnati:

• Avondale

• Bond Hill

•Carthage

• Clifton Heights

• Corryville

• Downtown

• East Price Hill

• East Walnut Hills

• Evanston

• Lower Price Hill

• Madisonville

• Oakley

• Over-the-Rhine

• Sedamsville

• Walnut Hills

• West Price Hill

• Westwood

Proposed TIF Districts

• Camp Washington

• College Hill

• Eastern River

• Mt. Airy

• Mt. Auburn

• North Fairmount

• Northside

• Pleasant Ridge

• Riverside

•Roselawn

• South Cumminsville

• South Fairmount

• Spring Grove Village

• West End

• Westwood Boudinot