This is a challenging article for me to write, because it hits close to home. Guardianship: Who will take care of my children if my wife and I were to both pass away suddenly?

It's a question so painful to think about that many parents simply don't think about it — and that can prove to be a huge mistake.

Why worry about it? In the most generic sense, you don't have to. Each state has intestacy laws (intestacy refers to laws that determine what happens to your property in the absence of a will) that determine, based on a simple set of rules, who would have the opportunity to claim custody of your children.

Grandparents, aunts and uncles often are options. In most loving families, the people will come together and find a solid and workable solution for your children.

The only problem with this solution is that you have no voice in the matter. Your extended family and the state will make this decision, not you and your spouse.

Questions to Ask When Picking a (Possible) Guardian for Your Children

· Does the potential guardian share your values? In other words, does the potential guardian believe in the same things that you believe in and have many of the same philosophies about raising children that you do? To borrow from Les Miserables, you don't want your little Cosette put in the hands of the Thenardiers even if you believe they have the means necessary to raise your child.

· Do you believe the guardian will raise your child in accordance with those values? Is that potential guardian a good person? If you're not confident of his or her character, you might not want to have your child raised by that person. For example, the guardians we selected for our own child have vastly different interests than we do, but I know their character — our children will be in good hands with them.

· Does that potential guardian have a strong family network around him or her to help with the burden of having unexpected (and likely traumatized) children? Likely, if you die suddenly, the lives of the guardians you selected will be turned upside down. Does your guardian have the appropriate network of support to ensure that your child's life doesn't quickly descend into chaos? It's often a good idea that the potential guardian lives near your child's grandparents.

· Will that potential guardian teach your children the basics of success in life? In other words, you wouldn't want to turn your children over to someone who would be incapable of teaching your child basic life skills. Can the guardian manage his or her own life effectively?

· Does that guardian have the financial security to ensure that your child's needs are met? In other words, if they're struggling to make ends meet right now, dumping two children into the situation might not be good unless you're adding your own financial support.

· Will that guardian have an expected natural lifespan that will allow them to remain as guardian until your child enters adulthood? Your children have already gone through the trauma of losing both parents. Why would you want them to go through the trauma of losing a guardian as well?

The relative values of each of these questions likely will vary a lot depending on your personal values, but they're all worth considering. When making our decision, we actually compiled a giant list of everyone whom we'd even consider as a guardian, then gradually eliminated people one at a time, eventually winding up with three strong candidates.

After a lot of discussion, we decided to choose guardians that had the best access (by far) to grandparents for support in raising our kids — that was our tiebreaker.

Planning for the Situation

If there's a scenario in which you and your spouse have both passed on and your guardian gains custody of your children, you'll want your estate to be used to ensure that your child has every success in life.

Your will needs to specify your guardianship plan. You might even want to specify multiple guardians so that if your first choice is somehow unable to take on the responsibility your second choice is clearly stated. Consult a lawyer and ensure that your will is set up properly and legally so that your wishes will be carried out.

The most effective method of ensuring your children get their assets might be to set up a living trust right now, so that if you do pass away your property is considered part of that trust and can be distributed by the trustee. Within that trust, you could specify rules for disbursement to your children at certain periods in their lives. You'll need to identify a trustee to handle this task, someone you deeply trust that you're confident could handle the task with good faith.

If you don't have significant assets and your primary gift to your children is your life insurance, you can specify in your will that these cash assets are placed into a trust for them. Again, you'll need a trustee you really trust and, again, you should contact a lawyer to get the specifics worked out.

Your children are some of the most valuable things you'll ever give to the world. Take the time right now to ensure they're well taken care of if something happens to you.

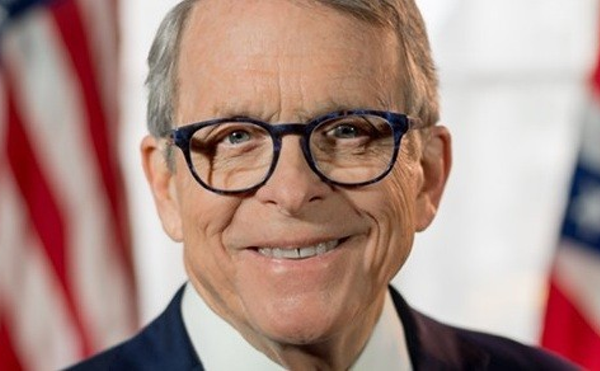

TRENT HAMM blogs about personal finance at www.thesimpledollar.com.