Worker pay was up and CEO compensation was down last year in Ohio. Even so, most of the state’s largest publicly traded companies paid their top executives at least 200 times as much as they paid their median worker, according to Policy Matters Ohio’s annual report on CEO compensation.

It said the yawning pay gap between CEOs and their employees narrowed, but now is growing again.

That’s because worker pay increased 10% between 2021 and 2022. At the same time stocks — which CEOs tend to own in great quantities — dipped in value, but have since almost fully recovered, the report said.

Huge increases in pay for top executives can accelerate income inequality, which if it becomes excessive, “can erode social cohesion, lead to political polarization, and lower economic growth,” according to the International Monetary Fund. In a sign that such excess could be a reality in Ohio is the fact that nearly 30% of the population — 3.4 million — are on Medicaid, the federal-state health program for the poor.

Excessive disparity also seems to be true nationally. In a measuring inequality, the Organization for Economic Cooperation and Development found that it’s been increasing in the United States over time and that it’s the fifth-worst of the group’s 38 member countries.

Overpaying people at the top can be a self-aggravating problem, the Policy Matters Ohio report said.

“Excessive CEO pay matters because the income captured by CEOs exerting their unique positions of power to influence pay could otherwise have gone to other working people — the people whose work made that income possible,” it said.

The report looked at CEO pay at the 53 publicly traded companies that employ the most Ohioans. And it found that the median employee made just over $53,000 in 2022, while the median CEO compensation received just under $13 million — or 245 times as much.

Among the companies with the biggest disparities was Walmart, which employs more than 55,000 Ohioans. While their median pay was about $27,000 last year, CEO Doug McMillon made more than $25 million, the report said. In other words, Walmart values McMillon alone more than 925 rank-and-file employees combined.

Policy Matters Ohio and other organizations have argued that the problem stems in part from the fact that wealthy CEOs have too much control over how they and others are paid. They and their cronies on corporate boards form compensation committees and engage in stock buybacks — sometimes over the wishes of the other shareholders.

Instead of reinvesting profits in research, equipment or in rank-and-file employees, companies often use a hefty chunk of that money to repurchase shares of company stock — which increases the value of those shares and those that remain outstanding. Because CEOs and members of corporate boards tend to own a lot of stock in a company, spending billions to buy up stocks has the effect of giving themselves a fat raise.

Such buybacks were banned as a form of stock manipulation in the Securities and Exchange Act of 1934 until Congress repealed them in 1982, the report said. CEO pay skyrocketed, increasing 1,209% between 1978 and 2022, the Economic Policy Institute reports.

And companies that employ the most Ohioans plan to engage in more stock buybacks, the Policy Matters report said.

“At least 38 of the 53 Ohio companies reporting indicated recent share repurchases or plans to make repurchases over the coming year,” it said.

The report proposed a number of steps to ease income inequality between the top corporate brass and regular workers:

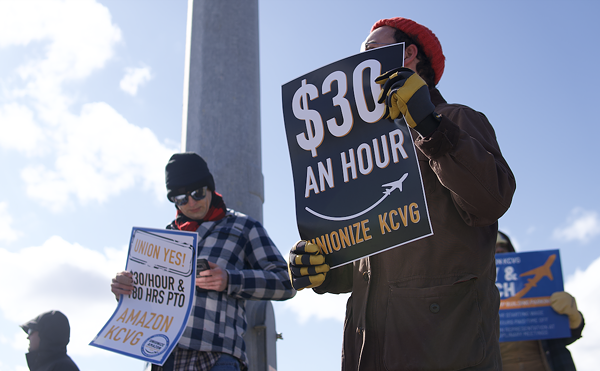

Prohibit share buybacksMake shareholder votes binding — “Investors, including union pension funds, have increased their use of ‘say on pay’ and other shareholder votes in recent years,” the Policy Matters report said. “However, shareholder votes for most large companies are advisory only, leaving corporate boards free to disregard them and pay executives as they chose, even when shareholders disagreed.”Impose tax penalties on companies with excessive CEO payGive preference for government contracts to companies with more reasonable pay differentials.Limiting the wild pay disparities would be good economically and it would be fair to Ohio workers, the lead author of the Policy Matters report said.

“Last year’s dip notwithstanding, CEOs have captured enormous pay gains over decades by leveraging the bargaining power they have on corporate boards,” Michael Shields, an economist, was quoted by Policy Matters as saying. “CEO pay came from wealth that working people created, but their wages didn’t grow along with it.”

This story was originally published by the Ohio Capital Journal and republished here with permission.

Follow us: Apple News | Google News | NewsBreak | Reddit | Instagram | Facebook | Twitter | Or sign up for our RSS Feed